Federal Budget 101 Part 3

Government, like individuals, borrows money and has debt. Debt can be a problem if you have too much and can’t make the payments. It can be a problem if you are using debt for the wrong reasons. Partying on the credit card is not good. Using debt to invest in your future (buying a house, starting a business, going to college) can be a wise choice. Unfortunately much of our federal spending is not spent wisely to build the public good or invest in our people’s future.

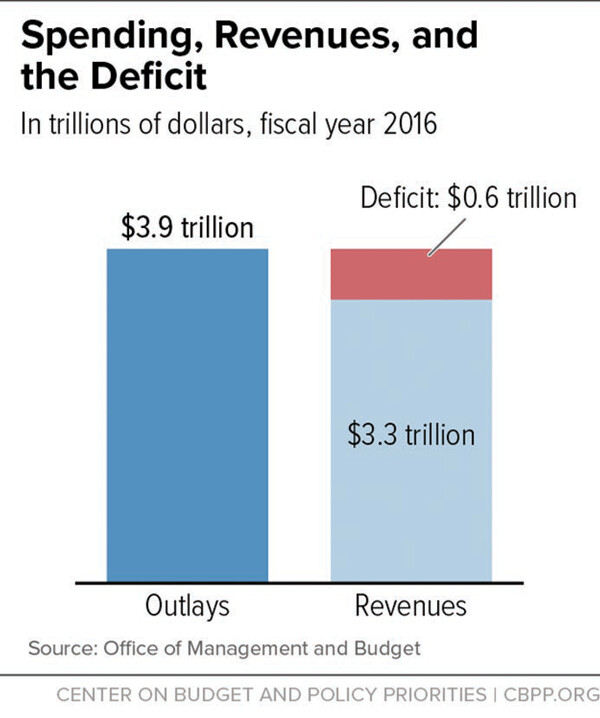

The national debt is the sum of all past deficits and currently totals about $19 trillion. In 2015, the federal government paid $229 billion in interest on this debt. In comparison total U.S. debt (government, business and households) is about $60 trillion.

U.S. Treasury bonds are the way we borrow and finance the federal debt. They are one of the the safest investments in the world. Many people, companies, and governments buy treasury bonds with their surplus cash. This includes foreign investors and governments. But most of the national debt is owned by ourselves. Private domestic investors hold 15%. The Federal Reserve owns 14%. State and local governments own 5%. Other federal agencies hold 28% (mostly in the Social Security trust fund). The federal government has never failed to meet interest payments on this debt.

Much of the concern over deficits and the national debt is exaggerated. We are not going bankrupt. We all benefit from this debt and the government services it finances.

There are three major causes of federal debt: excessive military spending, excessive health care costs, and tax breaks.

Historically the Pentagon has consumed about half the discretionary budget. This only includes the Department of Defense, nuclear weapons costs, and the Overseas Contingency Fund (wars in Iraq and Afghanistan). It does not include ALL the “national security” related spending. For example, the Veterans Administration, which is directly related to the consequences of war, is not included. When the Department of Homeland Security, Department of State, the FBI, Veterans Administration and defense related interest on the debt are included the total national security spending is 85% of the discretionary budget! This is before the recent 10% increases in defense spending. No other nation spends anywhere near this amount on defense.

You can not reduce the national debt without cutting defense spending. This must include serious efforts to reign in the rampant waste and fraud that is endemic to military spending. There are many ways to reduce spending and achieve better financial controls without hurting security. But neither political party has had the political will to take on the vested interests that profit from our national security paranoia.

Another driver of national debt is healthcare costs. We have the most expensive healthcare in the world. The federal government is a major buyer of healthcare services. Health care is the fastest-growing category of federal spending and in 2015 totaled $1.1 trillion (source National Priorities Project). This is almost as much as the total discretionary budget. The Defense Department spends 10% of its budget on healthcare so fixing this problem would also reduce military spending!

Most of this spending goes to private, for profit healthcare providers, insurance and drug companies. The “healthcare industrial complex” costs, like military costs, are out of control. Federal spending on healthcare has gone up for many reasons. The Affordable Care Act, expansion of Medicaid, and an aging population qualifying for Medicare have increased the number of people covered by federal programs. But drug prices (and drug company profits) have also increased dramatically. The excessive cost of healthcare impacts individuals, businesses and government at all levels. A rational, comprehensive, universal national healthcare system is needed to control costs.

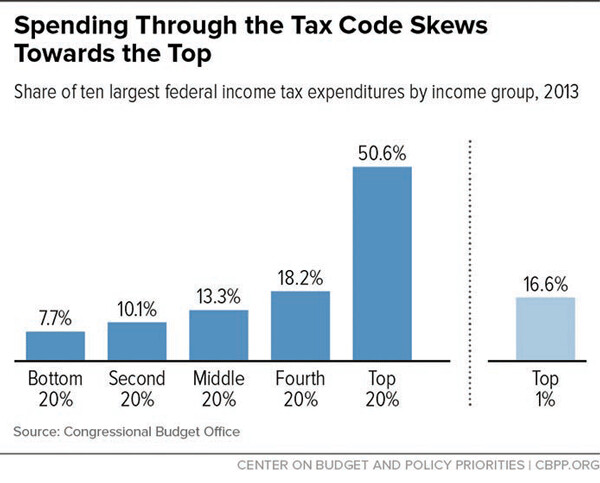

The third major cause of deficits and national debt is tax breaks. Tax breaks have a cost just like spending (economists call them “tax expenditures”). As I mentioned in last week’s article, the cost of various tax breaks adds up to more than the entire federal discretionary budget. Even though almost everyone qualifies for some tax break, most of the benefits go to higher income folks. Most of the value goes to the upper 20% of income earners.

Tax breaks have long standing bi-partisan support. No one is going to mess with the home mortgage deduction, for example, even though it costs $70 billion a year and does little to actually promote home ownership (source: Center on Budget and Policy Priorities). Capital gains tax breaks equal $108 billion per year. Most tax breaks benefit large businesses. Charitable deductions cost $50 billion a year. Most people give regardless of the deduction.

The biggest tax expenditure is the employer deduction for employee health insurance. This cost $236 billion in 2018 (source: Tax Policy Center). Again, a single national healthcare program that covered everyone would make this unnecessary. A comprehensive system would be far cheaper (and better for most people) than the current fragmented maze of public, private, and non-existent insurance.

Although neither party is blameless, Republicans are largely responsible for deficits and increasing national debt. The recently passed tax bill and 2018 budget are proof. The tax “reform” legislation will increase deficits by about $1.5 trillion. The $1.3 trillion budget deal just passed will add more. The continuing wars all over the Middle East are piling up more trillions of debt on the national credit card. There is bi-partisan support for spending over a trillion on new nuclear weapons and delivery system. Neither party has the political will to actually fix healthcare costs, reduce tax breaks, or reign in military spending.

Budgets are about choices. Congress could choose to spend our national resources more wisely. We could have national health program that covered everyone and controlled costs. We could invest in debt free college and job training for everyone. We could have a world class public transportation system. We could lead the world in environmental protection and green energy. We could create prosperous, clean, safe, sustainable local communities. We don’t lack the money.

We lack the wisdom and political will to make it happen.