Taxes are good

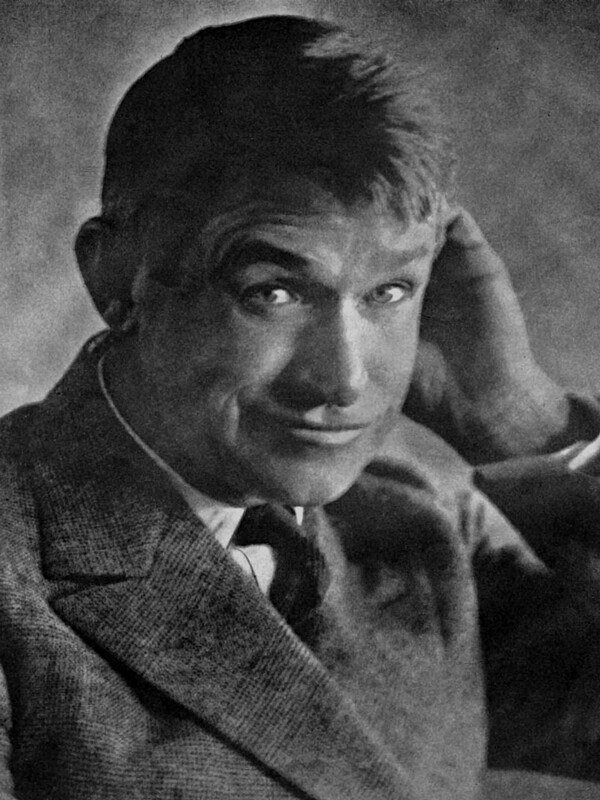

Will Rogers lived before the days of endless tax cuts so he had a jaded view on the issue. He wasn't observing a Congress and administration who would slip tax cuts for the very wealthy into legislation ostensibly intended to provide relief from a major public health disaster.

The conservative mantra is that government is too big and needs to be cut. Government is the problem and not the answer. So leading up to the current corona virus pandemic, the budget for the Centers for Disease Control was cut and the National Security Council epidemic response team was fired to save on taxes. The pandemic demonstrates the vital need for well funded pubic services. This tax season is a good to to remind ourselves of the good that comes (or should be coming) from our taxes.

There is a great website (and book by the same title) which addresses this subject in wonderful detail. Government is Good, An Unapologetic Defense of a Vital Institution (governmentisgood.com/index.php) by Douglas J. Amy, Professor of Politics, Mount Holyoke College, is essential reading for all citizens, especially progressives.

Professor Amy does a terrific job countering the conservative demagoguery on taxes with hard facts and good reasoning. He says, “Most conservative criticisms about the ill-effects of taxes are exaggerated or untrue. Taxes are in fact good – they are dues we pay to enjoy the numerous vital benefits that government provides for our society. Taxes are the way we come together as citizens to build communities. They are the way we work together to meet the needs of people and provide 'public goods' necessary for a civil society. Our economy, and everyone's well being, depends on: Public infrastructure like roads, water systems, sewer systems, airports and harbors· Courts and the legal system · Public health, safety, labor, financial and consumer protection rules · Police and firefighters · Food, water, product safety · Bank deposit insurance · Student financial aid programs · Social Security and Medicare · Public schools, colleges and universities · Disease control · National Weather Service · Basic scientific research · Retirement program insurance for private business · Disaster relief · And much, much more that government provides though taxes.

Do we pay too much in taxes for these necessary services? Everyone likes to complain but 85% of us pay less than 10% in federal income taxes. In 2011 Americans paid, as a percentage of income, between 17% and 29% in total taxes. This includes all federal state, and local income, property, payroll, and sales taxes. Is this too much to live in the “greatest nation” in the world?

Conservatives claim taxes are bad for the economy and tax cuts “stimulate” the economy. If this were true we would have had boom times since 1980 and the Reagan administration. Their arguments sound good but are obviously ridiculous. Government does not remove tax money from the economy. Tax cuts for the wealthy increase their wealth and not the overall economy.

Government at all levels is a major employer and a consumer of private sector products. Government uses tax dollars to pay wages and buy things IN the economy. Government spending is about 40% of GDP. Government spending sustains the economy rather than hurting it. Government spending smooths recessions and provides a stable economic base.

In addition, government is the referee and rule maker that makes the private sector work. Business could not function without protections for private property, a legal framework, and the court system.

Are you better off keeping your “hard earned” money, as conservatives like to claim? Can you spend your money better than the government? Most people do not pay enough in taxes to pay for the services provided to everyone through efficient government programs. Can you plow your own road or protect your family from bank fraud, natural disaster, or disease?

Is the private sector more “efficient”? Is government incompetent and wasteful? Social Security operates on 4% overhead. The Postal Service delivers nationwide for pennies. Air traffic control and bank deposit insurance are very cost effective. All large organizations can have problems including private sector businesses.

We should deal with these problems when they arise and not blindly accept false stereotypes. Conservatives claim budget deficits are terrible and must be controlled – at least that is the story until they want a war or a corporate bailout.

Budget deficits can be a problem, but cutting vital public services is not necessary. We can reduce deficits by increasing revenue instead of endless tax cuts. We can cut subsidies, tax breaks, and loopholes that often do nothing to stimulate the economy or accomplish desired goals.

Tax breaks to individuals and businesses will cost $1.24 trillion in 2015, more than the total federal discretionary budget. Sixty percent of businesses pay NO income tax and many wealthy individuals pay a smaller percentage of tax than working people.

We can stop tax cheating. We lose $400 to $500 billion a year in lost revenue to fraud and cheating.

No rational discussion of federal budgets can ignore Pentagon spending and the costs of the recent wars. The Pentagon spends 55% of the federal discretionary budget. The Center for Defense Information says total “national security” spending for all government agencies is more than $1 trillion. Obviously this is a huge area where waste could be eliminated.

The conservative ruling elite (whether Republican or Democrat) benefit from the most people's ignorance on tax issues. It is an easy way to manipulate people. Again quoting from Professor Amy's website and book,

“This anti-tax campaign strikes a real emotional chord in some Americans and it has been one of the most effective rallying cries of anti-government conservatives. It taps into a taxophobia that is deeply ingrained in American political culture...”

Taxes are one of the most effective “wedge” issues used by conservatives to keep people voting against their own best interests. They have been so successful at this agenda that many “liberal” politicians are afraid to defend successful government programs and the necessary taxes to support vital public infrastructure and services. Taxes are the dues we pay to live in a modern, civil society.

Rather than complaining about taxes, we should be thankful for the many public activities that build successful communities and make all our lives better.