The Dilemma of Spenders and Producers

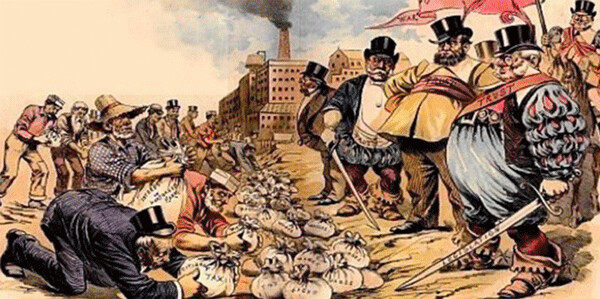

The Carnegies, Rockefellers, and Vanderbilts all killed workers who protested their wages and working conditions. They gained so much wealth using such tactics it has kept their descendants from soup lines for five generations. After acquiring so much wealth, power, mansions, and personal possessions enough to boggle our minds even today, these three families did do paybacks. Andrew Carnegie built 25,000 libraries across this great expanse of country. I used to use the one in downtown Fargo all the time. John D. Rockefeller founded and supported several colleges and universities. The University of Chicago is still leading the world in several fields—even if it doesn’t field a Division One football team. Cornelius Vanderbilt built the 254-room Vanderbilt Mansion at Ashville, North Carolina for his family’s personal use. At the same time he started a school for poor blacks and developed dairy farms, wineries, and other crops that utilized thousands of acres. In the end he hired thousands to work on the estate. He later gave thousands of acres to the federal government for parks, conservation, and for recreation.

The Minneapolis Tribune on Labor Day 2018 reprinted its Labor Day editorial of Labor Day 1926: Labor, Not Leisure, Is America’s Story. Two sentences say it all for the 92 years separating the period: “The mere splendor of what others accumulated for him is usually a negligible factor in the body social. The spender must also be a producer if he is to have standing in the court of common opinion.” In other words, the very wealthy can spend money on yachts, mansions, estates, fur coats, diamonds, travel, leisure, and gold ornaments. But the big spender must also be a producer if he is to have any standing in the society he lives in. His spending must not only create labor to satisfy his needs and fancies, he must create labor for others to serve the common good. Paying a fair share of taxes to build infrastructure such as roads, bridges, airports, and hydroelectric dams that serves everybody turns the rich man into a producer.

Are American Billionaires Spenders Or Producers?

Since the economic inequality of the Gilded Age of J.P. Morgan and the Rockefellers and the Great Depression, social scientists have been studying the attitudes of rich white families. Chris Hedges summarizes the work of social scientists Michael Kraus, Paul Piff, and Dacher Keltner of the University of California in his article The Pathology of the Rich White Family: “The pathology of the rich white family is the most dangerous pathology in America. Only 184 rich families provide 50% of all political campaign funds. Democracy is not even on life support. The rich white family is cursed with too much money and privilege. It is devoid of empathy, the result of lifetimes of entitlement. It has little sense of loyalty and lacks the capacity for self-sacrifice. Its definition of friendship is reduced to ‘what can you do for me?’ it is possessed by an insatiable lust to increase its fortunes and power. The rich believe that poor black people need to pull up their pants, stay in school, get an education, find a job, say no to drugs, and respect authority. If they don’t they deserve what they get.” The Donald Trump family is precisely defined in the research. Donald’s “golden” apartment in Trump Towers, his personal passenger jet with all of the gold fixtures and the big TRUMP in gold letters on the outside tell a lot about him. He is a spender, not a producer.

The scientists have concluded the poor have more empathy than the rich. The poor do not have the ability to dominate their environments; they must build relationships with everyone. This requires them to read the emotions of those around them and respond with a friendly manner. Such reactions demands they must look after each other. This makes them more empathetic. The rich don’t have to do any of this. The longer they live at the center of their own special universe, the more callous, insensitive, and cruel they become.

We Have A New Economic Class

Since the Great Recession of 2007 we have seen unemployment explode to 10%, four million Americans lost their homes to foreclosure, the net worth of the top 10% is up 26.6% while the net worth for American families is down 30%. A decade later we virtually have no middle class. It has been replaced by the “Precariat Class,” which comes from the world “precarious” which means “dangerously lacking in security or stability” or “subject to chance or unknown conditions.” The term is becoming popular among economists to describe former members of the middle class who possess all the skills that used to be associated with rising incomes and opportunities to advance to the upper levels—but find themselves in a precarious position of living paycheck to paycheck, depressed and shaken, and having children is a disaster because you can’t afford child care. Women suffer more than men in the precariat class because they are paid less, suffer from situations involving pregnancy and expensive child care, don’t get promotions, and still face sexual harassment and domestic violence from men. Women also have jobs that require college degrees but often do not pay enough to live on. Think art history, child care, and other jobs that are not part of the STEM areas. As an example, the average San Francisco teacher’s salary is $69,000 but $117,000 is considered lower income in California!

If Our Economy Is So Good, Why Do 80% Of Our Families Live Paycheck To Paycheck?

The deck chairs of Titanic America are not only slipping off the deck, the deck itself is sinking under water. As the middle class has not made a dime in the last two decades, the cost of actually living has gone up 30%. Meanwhile the healthy wealthy hogs at the Washington trough are crowding out everyone who wants at least a share of the sweet corn. What does the rising stock market mean to the 80% living paycheck to paycheck? That means only the rich are getting richer! The Top Ten Percent own 84% of the stocks. Only 52% of families own a little stock. The 97%-white Republican Party passed a $1.5 trillion tax cut, claiming the results would lift all boats. Only yachts have been rising while all the lifeboats and rowboats are sinking. The 80% without life preservers received only 6% of the cuts in tiny bonuses and meager wage increases.

Ninety-four percent of the tax cuts have immediately flowed back to CEOs, corporations, and wealthy stockholders through stock buybacks and world-wide tax havens. Almost nothing was dedicated to infrastructure, scientific research, education, the expansion of businesses, or improving the social safety net. McDonald’s, as an example, spent $21 billion on stock buybacks between 2015 and 2017. If that money had been spent on wage increases for its 1.9 million workers, many of them on food stamps, Medicaid and other taxpayer-provided public benefits, each worker would have gotten a $4,000 raise, bringing some of them out of poverty. Starbucks got such a huge tax cut it could have given each one of its workers a $7,000 raise—but they got nothing. Buybacks were more important than workers.

While hedge fund managers and CEOs have made hundreds of millions of dollars in the last 30 years through such scams as carried-interest rules and tax haven financial atrocities, the bottom half of Americans have not earned a dime. They have stayed at $16,000. Facts: The average pre-tax income of America’s Top One Percent has more than tripled since 1980. The Top.001 Percent has risen more than 700%! If we just eliminated the insane carried-interest rules, billionaires would not pay income taxes at a lower rate than the $16,000 a year fast food cook.

Let’s Stop The Political BS About How Are Taxes Are Too High!

The 34 countries of the Organization for Economic Cooperation and Development(OECD) are the most developed in the world. We often hear we are the richest country in the world. We treat the bottom 80% of our citizens as if they live in a country near the bottom of the 190 in the United Nations. A modern society takes a lot of money to provide an education to all citizens so we remain competitive. It takes a lot of money to provide interstate and intrastate roads, bridges, railroads, airports, subways, seaports, and other infrastructure for business, government, and social concerns. It takes a lot of money to provide clean air, clean water, clear skies, and recreational areas for all citizens. Practically every other major country in the world has universal health care. Is health care a privilege of wealth or a right of citizenship? We haven’t figured that out yet. Isn’t health care a utility like sewer, water, and air? We spend twice as much as any other country on health care and often rank near the bottom of World Health Organization rankings. We are the only wealthy country in the top 22 that doesn’t have a paid sick leave policy. The price of insulin in the U.S. has more than doubled in the last five years. We have 1.25 million people on insulin that now runs $1,300 a month. Diabetes victims are dying by the dozens because they can’t afford insulin. It’s a terrible way to die because your blood turns acidic and your cells dehydrate.

We Rank 29th Out Of 34 Developed Countries

The most reliable survey of tax revenue is based on the rate of tax on the total gross domestic product of the country. We rank 29th out of the 34 OCED countries with a rate of 26%. Denmark leads the organization with 43%.Denmark is always at the top or near it when citizens are surveyed about happiness and opportunity. The OCED average is 34%. Only North Korea, Ireland, Chile, and Mexico have a lower rate than the U.S. I think it’s interesting that U.S. property taxes make up 10% of all taxes while the OCED property taxes are only at 6%. That indicates other countries collect more from income taxes at a higher rate than we do. Is that why we have so many millionaires and billionaires—and so many poor? Only Spain and Greece in the OCED have a higher ratio of poor to population.

The day after Labor Day Amazon became a trillion-dollar company run by a CEO who makes more in ten seconds than a median employee of his makes in a year. The richest man at in the world at $168 billion (more than the state budgets of the 19 smallest states combined!) , between January 1 and May 1 of 2018 Jeff Bezos’ wealth increased by $275 million per day. Meanwhile many thousands of Amazon employees rely on food stamps, Medicaid, and public housing because their wages are so low. Senator Bernie Sanders, who often uses Bezos as an example of gross greed, wrote: “I have never understood how someone could have hundreds of billions of dollars and feel the desperate need for even more. I would think that, with the amount of money he has, Jeff Bezos might just be able to get by. I think there is something weird and wrong with people who have that much and are willing to step over working people, many with families and young children, in order to get more and more.”