Federal Budget 101

Part 2

There is a lot of misinformation in the media about taxes. Both conservatives and liberals promote false claims about how much we pay and who pays taxes. Whining about taxes has been a national pass time since 1774. But taxes are the dues we pay for a civilized society. We all depend on the vital public services that government provides. Many people exaggerate the tax burden. Eighty five percent of us pay less than 10% of our income in federal income taxes. In 2011 Americans paid, as a percentage of income, between 17% and 29% in total taxes. This includes all federal, state, local taxes, as well as property, payroll, and sales taxes. Is this too much to live in the “greatest nation” in the world? This article provides factual information about how much we pay, who pays, and who does not pay federal taxes. The numbers on taxes can vary depending on the source but the basic information is not in dispute.

Who pays taxes? The federal government raises trillions of dollars in tax revenue each year with a variety of taxes and fees.

Total federal revenues in fiscal year 2016 were $3.5 trillion. Some taxes are dedicated to a specific purpose (payroll tax for Social Security and gas tax for highways) and other taxes fund the government in general (income taxes). There are three major major sources of revenue.

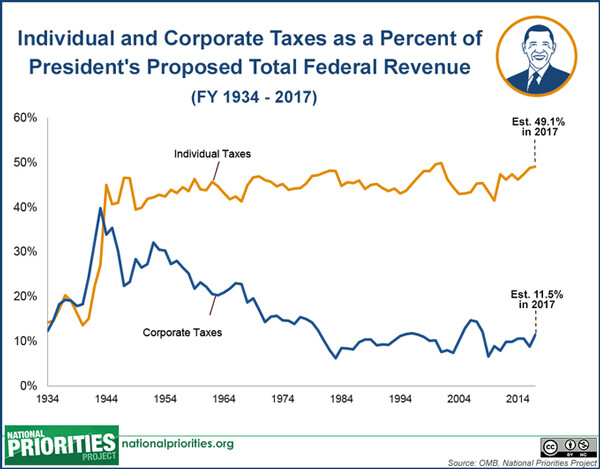

Income taxes paid by individuals were $1.65 trillion, or 47% of 2016 revenues. Payroll taxes paid jointly by workers and employers were $1.11 trillion or 32%. Corporate income taxes paid by businesses were $473 billion, or 13% of all tax revenues. Individuals pay roughly 80% of the taxes collected by the federal government.

Contrary to popular belief the “wealthy” do pay a lot in income taxes. People with adjusted gross income above $250,000 pay just over half of individual federal income taxes collected (Pew Research Center, 2014 data). This was about 25% of their income. People with incomes of less than $50,000 paid 5.7% of total taxes. Their average tax rate was 4.3%. It is also true that about 48% of people do not pay federal income taxes. They are too poor. They do pay payroll, sales, gas, and other local taxes.

The poor pay more of these taxes as a percentage of their income. Factoring in all federal taxes the U.S. tax system is somewhat progressive. The top 0.1% of families pay the equivalent of 39.2% and the bottom 20% pay nothing or get money back because of refundable tax credits.

Business and corporations are paying less in income taxes than they used to pay. In 2015, corporations paid 10.6% of total federal revenue ($343.8 billion). In the 1950s, companies paid between 25-33% of the bill. Today about 2/3 of corporations pay no federal income tax due to tax breaks and various loopholes in tax law.

Budget deficits. When Congress spends more in a fiscal year than incoming revenues there is a deficit. The U.S. Treasury borrows money to make up the difference. Budget deficits have occurred in 45 out of the last 50 years. Usually deficits are about 3% of the economy as measured by the Gross Domestic Product. So obviously running budget deficits in not the end of the world! All the deficits and borrowing accumulate into the national debt. In 2016 total national debt was $19.8 trillion or 106% of GDP. This is not as scary a number as it seems when put in perspective. The U.S. total public and private debt typically runs 3 to 4 times GDP.

The Social Security trust fund contributes nothing to the federal budget deficit. In fact it helps fund other government activities. Social Security has run a surplus each year since 1984 and in 2015 had $2.8 trillion worth of Treasury securities, earning an average interest rate of 3.4 percent during that year. The trust funds will earn $89 billion in interest income in 2016.

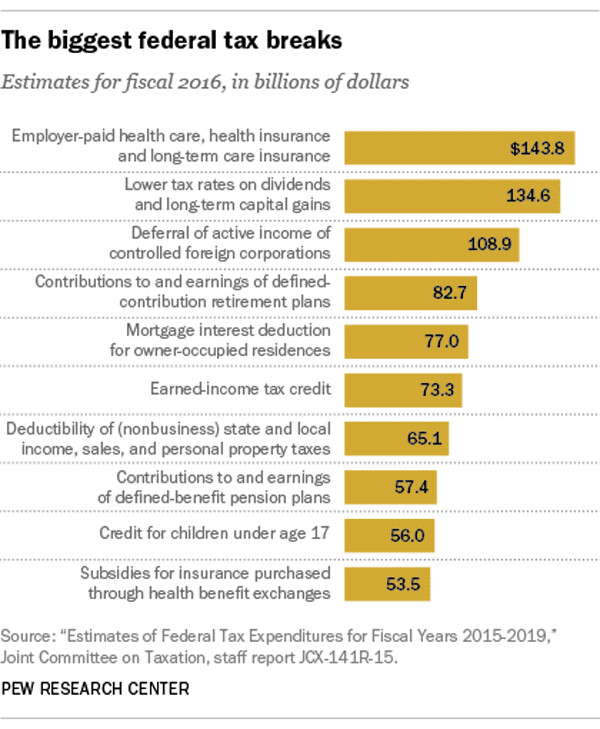

Tax breaks are a major cause of deficits. They have a “cost” that has the same effect on budgets as spending. But tax breaks are not annually approved like discretionary spending. From major corporations to poor people almost everyone has a tax break of some kind. Examples include home mortgage deductions, Earned Income Tax Credit, charitable contributions, and many business deductions.

In 2015 tax breaks to individuals & businesses cost $1.24 trillion, more than the total discretionary budget.

Are you better off keeping your “hard earned” money? This absurd idea is a staple of conservatives. But in reality individuals could never afford to purchase the services provided to everyone through efficient government programs. Can you snow plow your own road or protect your family from bank fraud, natural disaster, or disease? Taxes are the way we come together as citizens to build communities. They are the way we work together to meet the needs of people and provide “public goods” necessary for a civil society. We could not get along in a modern society without taxes and the essential services of government.

Part 3 will talk about the priorities we need to build better communities for ourselves and our children. Sources of analysis and data on taxes, budgets, and spending National Priorities Project, www.nationalpriorities.org Government is Good www.governmentisgood.com DEMOS www.demos.org/issue/revenue-taxes-and-budget Center on Budget and Policy Priorities on Social Security www.cbpp.org/research/social-security/policy-basics-understanding-the-social-security-trust-funds